Everything about 501c3 Nonprofit

Wiki Article

Non Profit Can Be Fun For Anyone

Table of ContentsThings about Non Profit OrgThe Single Strategy To Use For 501c3 OrganizationIrs Nonprofit Search Fundamentals ExplainedGoogle For Nonprofits Can Be Fun For EveryoneThe Ultimate Guide To 501c3 OrganizationSome Known Facts About 501c3.Indicators on 501c3 You Should KnowWhat Does Non Profit Organizations List Do?Our Npo Registration PDFs

Incorporated vs - 501 c. Unincorporated Nonprofits When people think about nonprofits, they typically believe of bundled nonprofits like the American Red Cross, the American Civil Liberties Union Foundation, and also various other officially developed companies. Nonetheless, lots of people participate in unincorporated not-for-profit associations without ever recognizing they've done so. Unincorporated nonprofit associations are the result of 2 or more individuals teaming up for the function of offering a public advantage or solution.Personal structures might include household foundations, exclusive operating structures, and also company foundations. As kept in mind above, they commonly do not supply any kind of solutions as well as instead use the funds they increase to sustain various other philanthropic companies with service programs. Personal structures also have a tendency to need more startup funds to develop the company in addition to to cover lawful costs and also other ongoing costs.

How 501c3 Organization can Save You Time, Stress, and Money.

The possessions remain in the trust fund while the grantor is to life and also the grantor might take care of the possessions, such as dealing supplies or property. All possessions deposited into or purchased by the trust fund stay in the count on with income distributed to the marked beneficiaries. These trusts can survive the grantor if they consist of a provision for continuous management in the paperwork used to develop them.

9 Simple Techniques For 501c3 Nonprofit

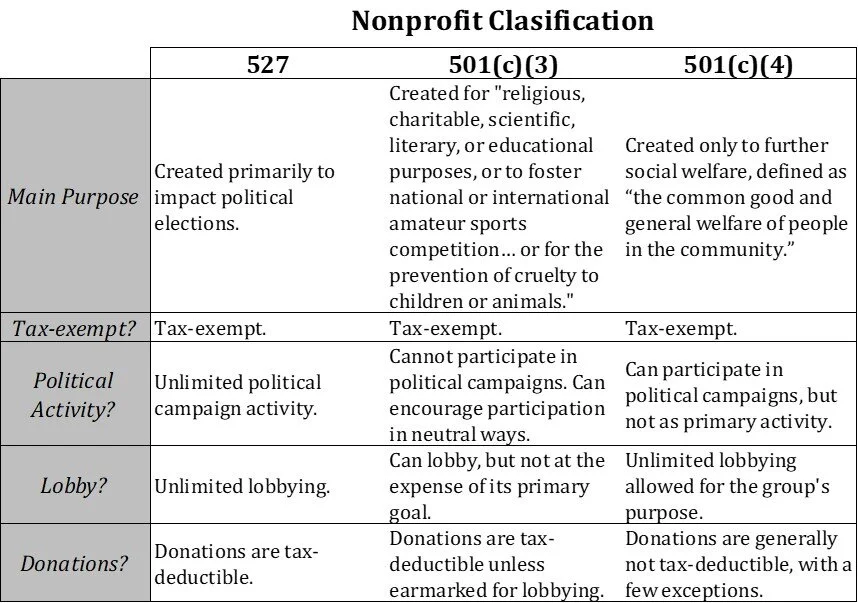

You can employ a depend on attorney to help you develop a philanthropic depend on and recommend you on exactly how to manage it relocating forward. Political Organizations While most various other forms of not-for-profit organizations have a restricted capacity to get involved in or advocate for political activity, political companies run under various regulations.

501c3 Organization Things To Know Before You Buy

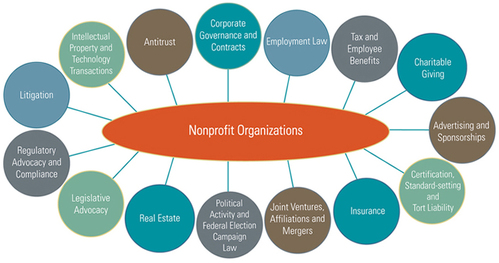

As you assess your alternatives, make certain to speak with an attorney to identify the most effective strategy for your company and also to ensure its correct configuration.There are lots of kinds of not-for-profit companies. All possessions and revenue from the nonprofit are reinvested right into the company or given away.

The 5-Second Trick For Npo Registration

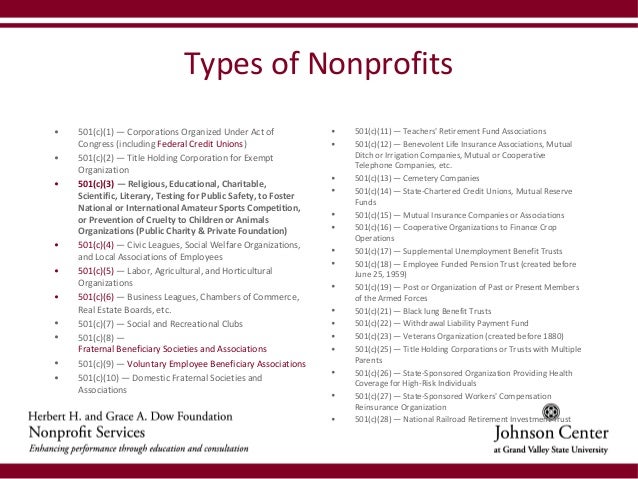

In the United States, there are around 63,000 501(c)( 6) companies. Some instances of well-known 501(c)( 6) organizations are the American Ranch Bureau, the National Writers Union, and the International Organization of Fulfilling Organizers. 501(c)( 7) - Social or Recreational Club 501(c)( 7) companies are social or leisure clubs. The function of these nonprofit organizations is to arrange tasks that result in enjoyment, leisure, and also socialization.

Not For Profit for Dummies

501(c)( 14) - State Chartered Debt Union as well as Mutual Get Fund 501(c)( 14) are state legal credit history unions and also common book funds. These companies use monetary services to their members as well as the area, typically at discounted rates.In order to be qualified, at the very least 75 find out here now percent of nonprofit business participants have to be present or previous participants of the United States Armed Forces. Funding comes from contributions as well as federal government gives. 501(c)( 26) - State Sponsored Organizations Offering Health Protection for High-Risk Individuals 501(c)( 26) are not-for-profit companies created at the state degree to provide insurance policy for risky individuals who may not have the ability to get insurance via various other means.

The Main Principles Of Nonprofits Near Me

Financing comes from contributions or government grants. Examples of states with these high-risk insurance swimming pools are North Carolina, Louisiana, as well as Indiana. 501(c)( 27) - State Sponsored Workers' Settlement Reinsurance Company 501(c)( 27) not-for-profit companies are developed to supply insurance coverage for employees' payment programs. Organizations that supply employees settlements are required to be a participant of these organizations and pay charges.A nonprofit company is a company whose purpose is something apart from earning a profit. 501c3 organization. A not-for-profit contributes its revenue to achieve a specific goal that benefits the public, rather list of 501c3 organizations than distributing it to shareholders. There more than 1. 5 million nonprofit companies signed up in the US. Being a not-for-profit does not mean the company won't make an earnings.

Facts About Not For Profit Uncovered

No one person or group has a not-for-profit. Assets from a nonprofit can be offered, however it profits the whole company as opposed to people. While any person can include as a not-for-profit, just those that pass the stringent standards set forth by the government can attain tax obligation excluded, or 501c3, condition.We talk about the steps to ending up being a not-for-profit further into this web page.

All about Non Profit Organization Examples

One of the most important of these is the capacity to obtain tax "excluded" condition with the IRS, which permits it to get donations totally free of gift tax obligation, permits contributors to subtract donations on their tax return and also spares several of the company's activities from revenue taxes. Tax obligation excluded standing is essential to lots of nonprofits as it motivates contributions that can be used to sustain the mission of the organization.Report this wiki page